The moment you believe in passive income is the moment you become someone else’s revenue stream.

Passive income vending machines represent one of business mythology’s most elegant lies—not because vending can’t be profitable, but because the word “passive” performs linguistic alchemy that transmutes labor into invisibility. The vending industry generates $23 billion annually in the United States, yet the operators building sustainable businesses aren’t the ones chasing passivity. They’re the ones who recognized that every income stream demands continuous intelligent intervention, and vending’s unique advantage isn’t reduced effort but compressed leverage points.

What must be true: Income doesn’t flow passively. It flows in proportion to the systems you actively engineer and the inefficiencies you systematically eliminate.

The passive income vending machine pitch works because it exploits a fundamental category error in how people understand business operations. The narrative presents vending as a install-and-forget arbitrage opportunity—you place machines, stock them occasionally, and collect compounding cash flow while you sleep. This framing omits the substrate: the invisible operational infrastructure that determines whether machines generate profit or become cash incinerators.

According to industry operations research, the average vending operator spends 15-20 hours per week on route management, inventory optimization, and machine maintenance for every 15-20 machines operated. This isn’t inefficiency—it’s the irreducible operational minimum for maintaining performance. The machines themselves are passive. The business is not.

“The vending machines don’t work for you. You work through the vending machines to arbitrage location access and convenience premiums.”

The destruction happens gradually. New operators, believing the passive narrative, underinvest in operational systems. They treat restocking as a chore rather than a data collection opportunity. They ignore route density optimization because “passive” means they shouldn’t need to care about drive time. They react to machine failures instead of implementing preventive monitoring. By month six, their effective hourly rate is below minimum wage, and they exit the industry blaming the business model rather than the narrative that set them up for failure.

The passive income pitch is a customer acquisition funnel for equipment manufacturers and franchise sellers. The operational reality is a filter that separates those who can build systems from those who expected magic.

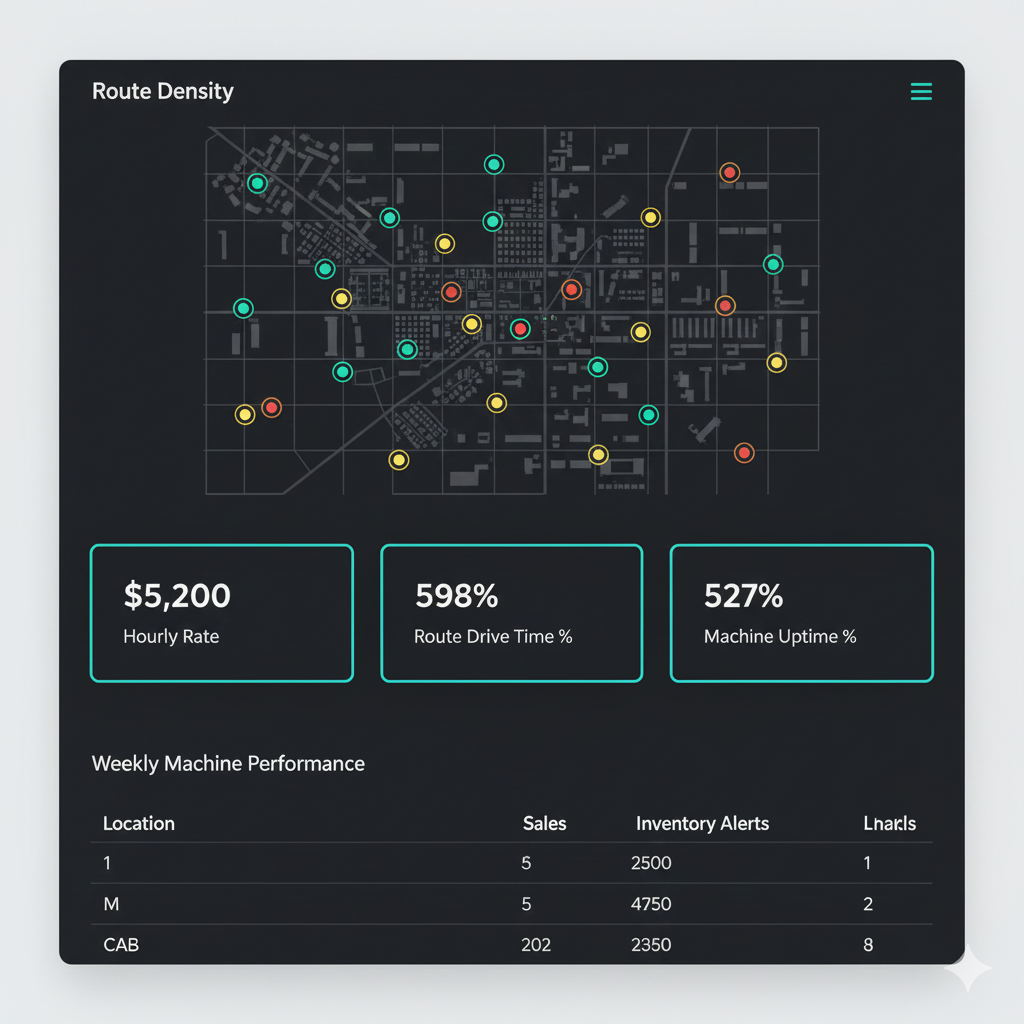

Route density—the concentration of machines within a defined geographic area—determines your operational leverage more than any other factor. Efficient routes concentrate 15-20 machines within a 5-mile radius, reducing drive time to 15-20% of total operational hours. Inefficient routes spread machines across 30+ miles, turning restocking into a full-time transportation job.

This isn’t a one-time setup decision. Route density requires active negotiation, location replacement, and strategic culling. Locations close. Businesses change ownership. New high-traffic sites open. According to route optimization studies in distribution logistics, a 10% improvement in route density can reduce operational time by 25-30% while maintaining the same revenue base.

The question passive income seekers never ask: How often are you evaluating location performance and actively replacing underperforming sites?

Passive income assumes static geography. Reality demands continuous territorial refinement.

Passive income vending machine operators stock based on intuition and product availability. They treat inventory as a procurement task. Sustainable operators understand that inventory is a capital allocation decision made 50-200 times per month (depending on route size and service frequency).

Every product selection represents a micro-bet on local consumption patterns, seasonal preferences, and price sensitivity thresholds. Research from the National Automatic Merchandising Association shows that optimized product mix can improve sales per machine by 20-35% compared to generic stocking strategies. But optimization requires data: sales velocity tracking by product, location-specific performance metrics, and systematic A/B testing of new product introductions.

This is active intelligence work. You’re not passively filling machines—you’re continuously adjusting capital allocation based on consumption signals. The machines are data collection devices. The passive income narrative treats them as vending devices and ignores the intelligence layer entirely.

“Your inventory isn’t what you stock. It’s how frequently you can afford to be wrong before data corrects your decisions.”

A broken vending machine generates zero revenue but continues generating fixed costs (location fees, capital depreciation, opportunity cost). Vending industry reliability data indicates average machine downtime of 5-8% across the industry, with top performers reducing this to under 2% through proactive maintenance protocols.

Passive income assumes machines run until they don’t. Active income engineering implements predictive monitoring: tracking bill acceptor failure rates, compressor run times in refrigerated units, network connectivity for smart coolers, and environmental factors (temperature, humidity) that accelerate component degradation.

Smart coolers with remote monitoring capabilities aren’t luxury features—they’re operational intelligence infrastructure. A $200-400 premium per machine buys you real-time failure detection, immediate response capability, and the difference between 8% downtime and 2% downtime. On a $1,000/month machine, that’s $60-80 in recovered monthly revenue per unit. The technology pays for itself in 3-5 months, then continues compounding operational advantage.

Passive income sees uptime monitoring as paranoia. Active income sees it as the minimum viable defense against entropy.

The passive income narrative treats location placement as a transaction: you negotiate commission terms, install the machine, and collect revenue minus the location fee. Reality: location relationships are ongoing negotiation frameworks that determine your margin stability.

Locations have leverage. They can demand higher commissions, request machine removal, or allow competitors to place superior equipment. According to commercial real estate data on vending placements, locations renegotiate commission terms every 12-24 months on average, particularly in high-performing sites.

Operators who treat locations passively face commission creep—gradual percentage increases that erode margins. Operators who maintain active relationships—providing sales data to location managers, demonstrating value beyond commission checks, and preemptively addressing concerns—negotiate from strength.

This requires systematic touchpoint management: quarterly performance reviews with location stakeholders, proactive communication about product changes or service improvements, and strategic value delivery (employee satisfaction scores, facility amenity perception) that makes removal painful for the location.

Passive income assumes contracts are stable. Active income knows that every relationship is a monthly referendum on your continued presence.

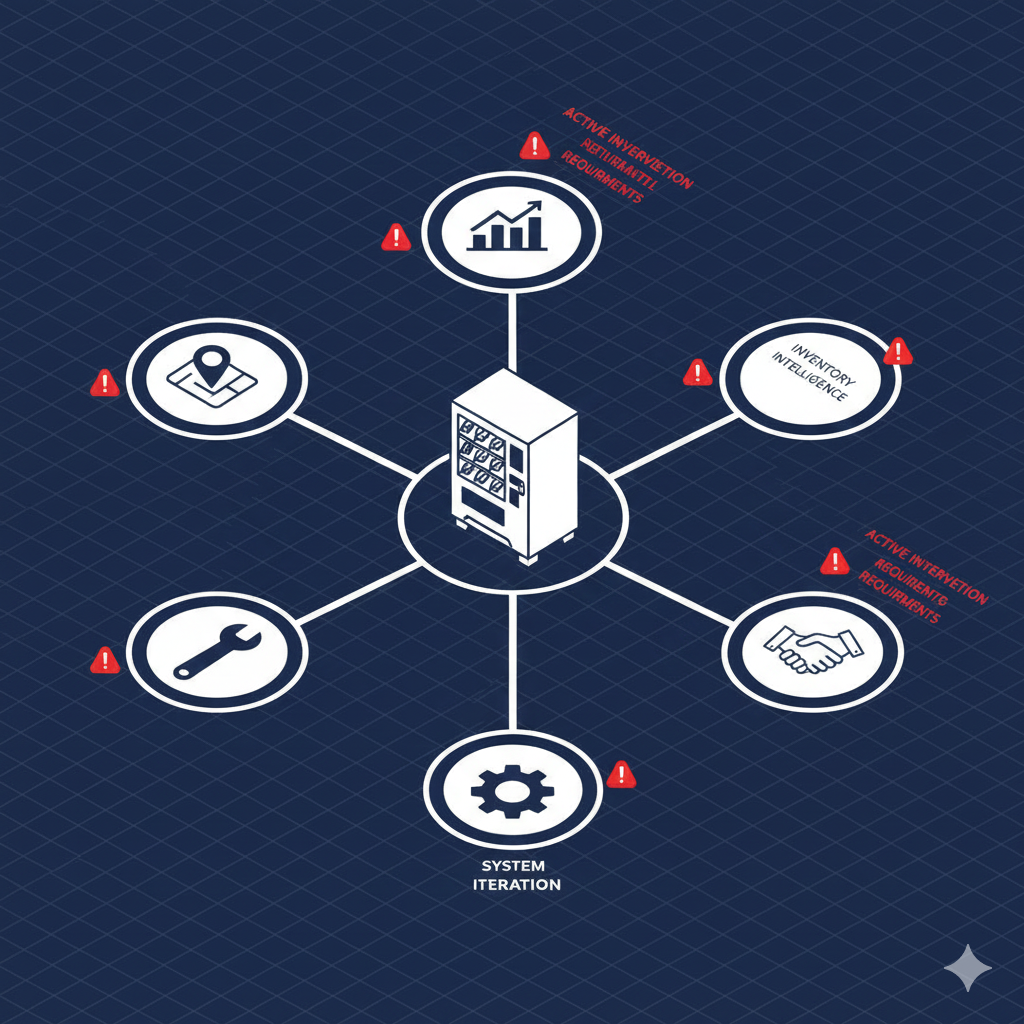

The passive income vending operator performs the same tasks the same way indefinitely. The active income operator treats every operational cycle as a system iteration opportunity.

Examples of compound iteration:

Operational research in service industries demonstrates that businesses implementing continuous improvement protocols (kaizen frameworks) achieve 15-20% annual efficiency gains compounded over 3-5 year periods. This doesn’t happen passively. It requires dedicated time for system analysis, hypothesis formation, and controlled testing.

The passive income vending operator works IN the business indefinitely. The active income operator works ON the business systematically, compressing operational hours while maintaining or improving output.

If you are interested in learning about another metric that adds to the myth of passivity, check out my post on the importance of route density here:

Route Density In Vending: The Hidden Costs That Harm Operators

The sustainable model isn’t passive income—it’s intelligent leverage. You compress operational time through systematic efficiency gains while maintaining active oversight of critical decision points.

Real operators don’t pursue passivity. They pursue:

Operational leverage: Using technology (smart coolers, remote monitoring, cashless payment) to reduce manual intervention while increasing data visibility

Route density: Concentrating machines geographically to minimize drive time, then maintaining that density through active location management

Decision automation: Creating rules-based systems for routine decisions (reorder triggers, service schedules, price adjustments) while preserving human judgment for edge cases and strategic choices

Capital efficiency: Measuring true ROI including opportunity cost of time, then ruthlessly culling underperforming assets

The vending business model’s actual advantage isn’t passive income generation—it’s the ability to build location-independent revenue systems that don’t require your physical presence for every transaction. That’s not passivity; it’s architectural leverage.

“The best vending operators don’t work less. They work on higher-leverage problems while letting systems handle execution.”

Research from small business operational studies shows that successful service-based businesses with distributed assets (vending, ATMs, rental equipment) require 10-15 hours of weekly active management per $50,000 in annual revenue. This scales—200k in revenue doesn’t require 40 hours—but it never reaches zero. The work changes from manual execution to system oversight, but it remains active work.

1. Audit Your Actual Operational Time

Track every hour spent on vending operations for 30 days. Categorize: drive time, restocking, maintenance, administrative work, system improvement. Calculate your effective hourly rate (monthly net profit ÷ total hours). If it’s below your target wage, you’re subsidizing the business with underpriced labor.

2. Calculate True Route Density Metrics

Map all machines. Measure average drive time between locations. Calculate what percentage of your operational time is spent driving versus performing value-generating work (restocking, maintenance, relationship building). Target: 15-20% drive time for efficient routes. Above 25% signals density problems requiring active location management.

3. Implement Minimum Viable Data Collection

For each machine, track weekly: total sales, sales by product, cash vs. cashless ratio, out-of-stock incidents, service calls/failures. Use a simple spreadsheet if necessary. This data becomes your decision substrate for inventory optimization, payment system investments, and location performance evaluation.

4. Establish Preventive Maintenance Protocols

Create monthly inspection checklists: bill acceptor functionality, refrigeration compressor operation (for cold machines), door seal integrity, product display condition. Log findings. Identify patterns. Replace failing components before catastrophic failure. Smart cooler monitoring automates this—manual inspection is the baseline.

5. Design Location Touchpoint Calendar

Schedule quarterly performance reviews with location stakeholders. Prepare simple one-page reports showing: total sales, employee usage rates, any service issues resolved. This creates documented value delivery and prevents commission creep through demonstrated partnership rather than transactional presence.

6. Build System Iteration Time Into Weekly Schedule

Block 2-3 hours weekly for system work: analyzing sales data, testing new inventory configurations, researching operational improvements, reviewing route efficiency. This isn’t operational execution—it’s working ON the business architecture that determines your long-term leverage.

Income requires intervention. The vending business model’s actual value isn’t eliminating work—it’s creating systems that execute without your physical presence while demanding your systematic oversight. This is leverage, not passivity.

The operators who succeed don’t pursue passive income. They pursue intelligent architecture: compression of low-value tasks through technology and process design, elevation of focus to high-leverage decision points, and systematic iteration toward operational efficiency that compounds.

The passive income narrative sells because it promises transformation without sacrifice. Reality delivers transformation through precise understanding of which interventions matter and which can be systematically eliminated.

You don’t build a vending business by avoiding work. You build it by engineering which work creates compounding returns.