Route efficiency is not a choice. It is a constraint imposed by spacetime, fuel chemistry, and human metabolic limits. Every vending operator exists within a system governed by these laws, yet most build routes as if preference supersedes physics.

The distance between your machines multiplied by the frequency of service equals your cost structure. This is not negotiable. You cannot motivate your way past the second law of thermodynamics. You cannot hustle your way out of the relationship between velocity, distance, and time. Route density is the single largest determinant of operational profitability in vending, yet operators treat it as an afterthought—something to “optimize later” after acquiring more locations.

This is the operational equivalent of building a house without understanding load-bearing walls. The structure fails, slowly at first, then catastrophically.

Consider the fundamental equation of route operations:

Total Route Cost = (Travel Time × Hourly Cost) + (Fuel × Distance) + (Service Time × Stop Count) + (Opportunity Cost × Route Duration)

Most operators track the first two variables. The sophisticated ones track the third. Almost no one calculates the fourth, which is often the largest.

Industry data suggests that operators should target more than 10 stops per route hour for efficient operations. When routes are geographically dispersed, travel time can consume disproportionate resources—time that could be spent servicing additional machines or building density in profitable areas.

“Every mile between machines is a tax on every transaction those machines will ever process. You pay it in perpetuity.”

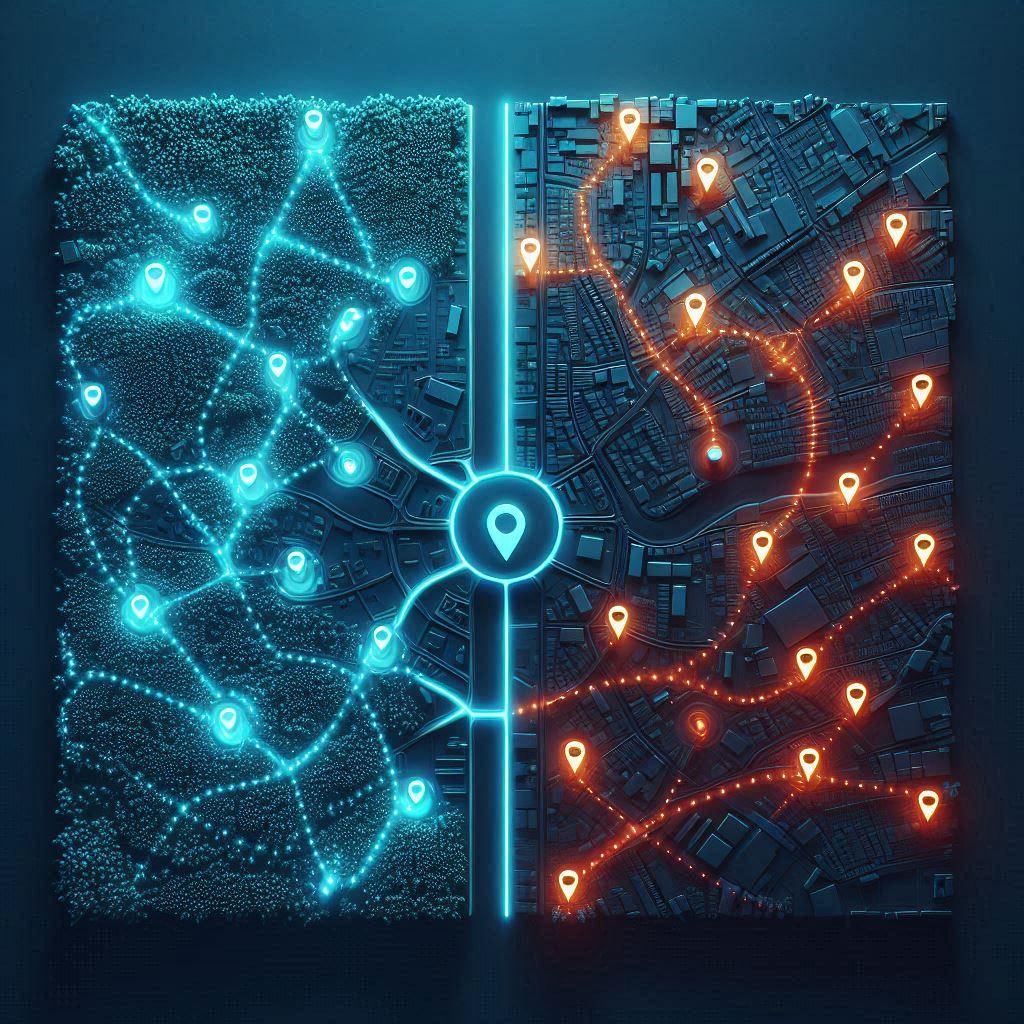

Let’s make this concrete. Consider two operators, each servicing the same number of machines, but with vastly different route density:

Operator A (High Density): Machines clustered within 10-20 minute drives of each other—the recommended industry standard for suburban routes.

Operator B (Low Density): Machines spread across much greater distances, forcing extended travel between stops.

At $0.67 per mile (the IRS 2024 standard business mileage rate, which captures fuel, maintenance, and depreciation), every additional mile of route distance directly impacts profitability. But this understates reality.

Travel time compounds. A typical full-line vending route driver services 15-20 machines per day. When those machines are dispersed, additional minutes per stop multiply across dozens of locations. At a $50/hour fully-loaded labor rate, these minutes become substantial labor costs that never generate revenue.

But we’re still not at the real cost.

The direct costs are visible. The hidden costs are structural.

When your routes are geographically dispersed, your service windows compress. If a machine malfunctions, your response time increases proportionally to your route density. This has cascading effects:

A single machine generating $800/month in revenue loses significant daily income when offline. If your dispersed route structure means machines stay offline longer per incident, these losses compound across your entire fleet.

Low-density routes force higher inventory levels in vehicles and warehouses. You cannot make targeted replenishment runs to individual machines economically when they’re spread far apart. Instead, you overfill machines during scheduled service, locking capital in slow-moving inventory.

The spread between optimal inventory levels (high density) and forced inventory levels (low density) represents capital deployed inefficiently—capital that could be generating returns elsewhere in your business.

Here’s what operators miss: route density isn’t linear. It has threshold effects.

At what point does adding one more machine to a dispersed route make the entire route unsustainable?

The answer depends on your service frequency requirements, vehicle capacity, and labor availability—but the threshold exists for every operator. Cross it, and you’re forced into a restructuring event: split the route (adding vehicle and labor costs), reduce service frequency (degrading machine performance), or decline new locations (limiting growth).

Most operators don’t identify this threshold until they’ve already crossed it. By then, they’re operating in what engineers call a failure mode—the system still functions, but at degraded capacity and elevated stress.

“You don’t notice route density problems until the day you can’t service all your machines in the available time window. By then, you’ve been bleeding for months.”

These costs don’t exist in isolation. They form a reinforcing system:

Poor density → longer routes → compressed service windows → degraded machine performance → customer complaints → harder to expand at existing accounts → forced to take distant locations to grow → worse density → longer routes.

This is a death spiral dressed as growth. Revenue increases while unit economics deteriorate. You’re building a larger, less profitable operation.

The sophisticated operator recognizes this pattern and refuses to enter it. They turn down new locations that degrade route density until they’ve filled their existing geographic footprint. This requires discipline that feels like leaving money on the table. It isn’t. It’s preventing future capital destruction.

What’s your actual maximum profitable route radius given your current cost structure?

Real-world implementation of route optimization demonstrates measurable results. Coinadrink, a UK vending operator, reported that intelligent route planning initially cut their routes by 25% while improving customer experience. Combined with AI-driven smart replenishment and improved machine capacities, they achieved an additional 15-20% route reduction.

These aren’t marginal improvements—they represent fundamental restructuring of cost basis. DFY Vending notes that clustering machines in high-density areas minimizes distance between locations, directly decreasing fuel consumption, vehicle wear, and time spent traveling.

The operators who build with density from day one compound these advantages over time.

Can you calculate the true fully-loaded cost of servicing your most distant machine?

Physics does not negotiate. Every mile between machines is a permanent tax on operations. Every minute of drive time is capacity you will never recover. The operators who understand this build differently. They grow slower geographically, denser locally, and with cost structures that compound advantage rather than debt.

The ones who do not eventually face the moment when they cannot service their routes in available time. They have built too large, too dispersed, too fast. The structure collapses not from lack of revenue, but from physics asserting itself against preference.

You cannot cheat thermodynamics. You can only acknowledge it earlier or later. Earlier is cheaper.

Route density is not where you optimize. It is where you either build correctly or pay forever.

If you want to learn more about how the vending business is a logistics buisiness disguised as a snack & drink buisiness, read my post here: Vending Machine Logistics: 3 Reasons Your Business Is Routes, Not Products